-

Call Us

+91 98883 35370 -

Business hours

Mon - Sat 10 AM - 5 PM -

Location

Near BFP School, Faridkot(PB)

Where Balance Meets Brilliance

Welcome to Pardeep’s Accounting Zone!

Here, numbers come alive and accounting education is transformed through expert guidance and a practical approach.

Our Courses

This course provides a comprehensive introduction to financial accounting principles and practices.

Professional Accounting

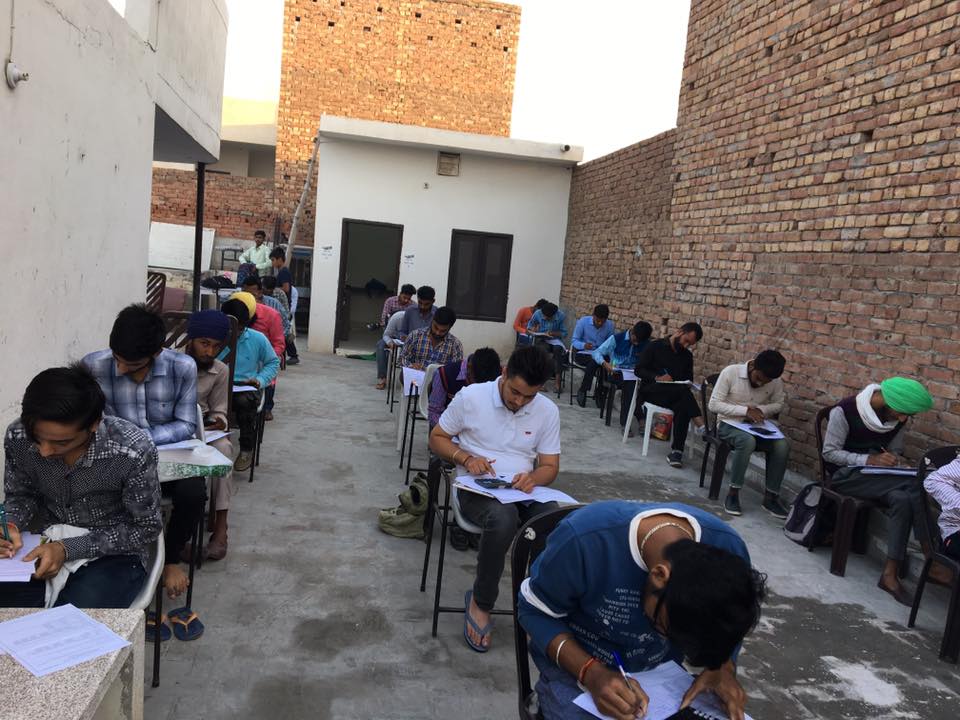

Professional Accounting programs prepare students for challenging and rewarding careers in commerce, finance, and allied fields. The curriculum emphasizes real-world application through case studies, projects, and internships, ensuring graduates are ready for professional roles.

GST & Returns

This course focuses on the legal framework, practical applications, and procedural aspects of GST. Participants will learn about GST registration, the structure of GST (CGST, SGST, IGST), computation of tax liability, input tax credit (ITC), and the filing of various GST returns

Income Tax

This course offers a comprehensive overview of the Income Tax Act, 1961, and its application in real-life scenarios. Students will learn about the different heads of income (salary, house property, business/profession, capital gains, and other sources), exemptions, deductions, and the computation of tax liability.

MS Office and Advanced Excel

This course provides hands-on training in Microsoft Office Suite, focusing on real-world applications in business and academic environments. Students will learn to create professional documents, spreadsheets, and presentations, manage emails, and collaborate using cloud tools.

Busy / Tally / Advanta Witty

powerful business management solution that simplifies accounting, inventory, payroll, and compliance processes. The course teaches users how to create ledgers, record transactions, manage inventory, generate financial reports, handle taxation (GST, TDS), and automate payroll.

Foreign Accoutig with Quick Books

This course offers a comprehensive overview of the Income Tax Act, 1961, and its application in real-life scenarios. Students will learn about the different heads of income (salary, house property, business/profession, capital gains, and other sources), exemptions, deductions, and the computation of tax liability.

120 Hours Computer Courses

A 120-hour computer course is a comprehensive training program designed to equip beginners and job seekers with essential digital skills for personal and professional use. The course typically covers fundamental computer operations, MS Office applications, internet basics, email management, and practical data handling, making it ideal for those preparing for government jobs or seeking entry-level IT roles.

Precision in Every Decimal

Our institute empowers learners of all levels to excel in accounting and finance. Join a community where clarity, confidence, and career success are at the heart of every lesson.